- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

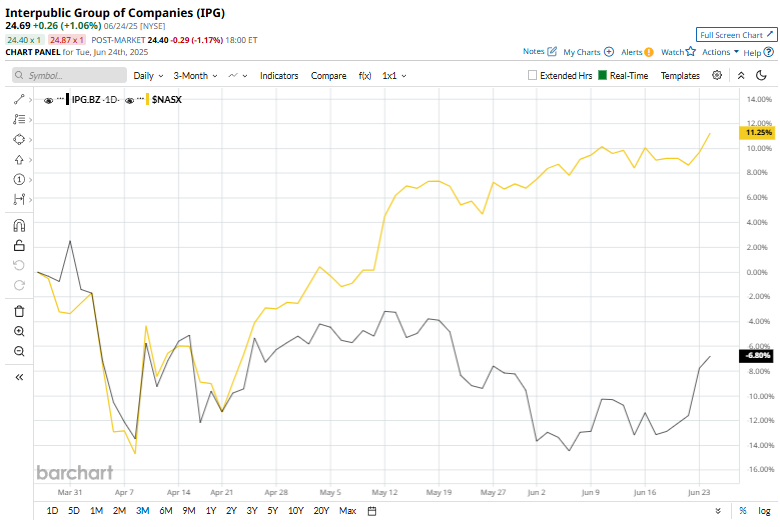

Is Interpublic Group Composite Stock Underperforming the Nasdaq?

With a market cap of $9 billion, The Interpublic Group of Companies, Inc. (IPG) is a global provider of advertising and marketing services. The New York-based company operates through three key segments: Media, Data & Engagement Solutions; Integrated Advertising & Creativity-Led Solutions; and Specialized Communications & Experiential Solutions.

Companies worth between $2 billion and $10 billion are generally described as “mid-cap stocks,” and IPG perfectly fits that description. The company benefits from a strong portfolio of well-known agency brands, a global operational footprint, and long-standing client relationships. Its integrated approach to creativity and data-driven solutions enhances its ability to deliver measurable results, while continued investments in digital capabilities position it well in the evolving marketing landscape.

IPG shares have faced challenges and are currently trading 25.3% below their 52-week high of $33.05, touched on Dec. 9, 2024. The stock has declined 4.8% over the past three months, underperforming the broader Nasdaq Composite’s ($NASX) 9.5% rise over the same time frame.

IPG has declined 1.9% on a YTD basis, falling behind $NASX’s 3.1% rise. Moreover, over the past 52 weeks, IPG's 16.3% decline has been outperformed by $NASX's 13.8% increase.

IPG has mostly remained below its 200-day and 50-day moving averages since the end of December, indicating a downtrend.

Interpublic’s stock jumped 4.5% on April 24 following the release of its Q1 results. While the company faced year-over-year declines in key metrics, organic net revenue fell 3.6%, total revenue dropped 6.9% to $2.3 billion, and adjusted EBITA and net income declined 9.2% and $11.3 million, respectively. These results were largely anticipated due to 2024 account activity.

On the upside, adjusted EPS came in at $0.33, beating consensus estimates by 10%, and the company reaffirmed its quarterly dividend of $0.33 per share, underscoring its commitment to shareholders.

IPG’s rival, Omnicom Group Inc. (OMC), has trailed IPG, with a fall of 15.8% on a YTD basis and 20.1% over the past 52 weeks.

Among the nine analysts covering the IPG stock, the consensus rating is a “Moderate Buy.” The mean price target of $31.25 suggests a 26.6% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.